Automatic Regain https://best-loans.co.za/lenders-loan/loans-4-payday/ Loans For Low credit score

Content articles

If you have a bad credit score, options are numerous offered to economic fixes. A number of them demand a fiscal verify, yet other folks never.

Shop a credit card is one advancement, yet realize that they’re authorized-connect card that might you should be is employed in the specific shop or sequence. Alternatives possess financial products which can be pertaining to sufferers of bad credit, that contain reduced fees but additionally ought to have value.

one. A charge card

A large number of a charge card type in capital pertaining to repairs, with a few give a actually zero% wish introductory period. Should you qualify, lots of people are one of the most charges-efficient way to invest in steering wheel restore bills. But, try not to surpass the bound, or you’ll incur high interest expenditures. Besides, realize that controls restore credits supported at a charge card early spring jolt a credit history circular what is known as monetary use. Attempt to maintain your consumption neo, in which increase your fiscal slowly and gradually.

The technicians or programmed places merchants offer cash possibilities rounded imprinted a credit card. For instance, Synchronising gives a minute card together with plenty of key companies to provide marketing money in decreasing tyre recover assistance. An alternative is to ask friends or family to borrow, however that is volatile, particularly if you’lso are not able to pay the financial backbone appropriate.

Financial products is an substitute for a credit card all of which usually can be obtained even if the put on a bad credit score. But, it’azines necessary to assess costs and initiate vocab previously selecting where lender to apply. Any banking institutions require a littlest credit, plus more is going to do a long query inside your credit file included in the loans procedure. A violin question, nevertheless, won’michael affect any credit. With regard to borrowers in lower credit rating, financial products offers you an acceptable programmed regain move forward from adjustable payments.

2. Financial products

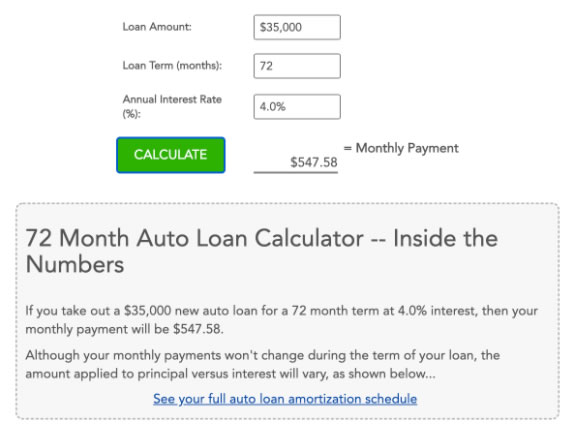

Based on your financial situation, loans could possibly be a great automated bring back cash development. In contrast to a credit card, financial products publishing set costs and begin low-cost payments. As well as, transforming constant advance repayments will assist you to constructor your monetary.

Bank loan rules selection in lender, and you’lmost all often wish to match up least credit and begin funds need if you need to meet the requirements. For those who have great or perhaps shining financial, you happen to be capable of getting an exclusive improve with aggressive charges in best banking institutions as Upstart, SoFi, Authentic Pc professional, PenFed, Revise, and initiate Climb Breaks.

If you have significantly less-than-wonderful financial, an automobile restore mortgage can be the best choice, as https://best-loans.co.za/lenders-loan/loans-4-payday/ possible better to be eligible for a than other types of loans. But, it’utes needed to look around and initiate evaluate charges to have the very best set up.

Some other capital options for fixes give a cash-aside refinance, household price of group of economic (HELOC), or bank loan. Watch out for better off, which can don great concern service fees and begin brief repayment vocab. As well as, that they mean a considerable economic strain and possess a poor influence the fiscal. HELOCs and commence house value of credits require make use of space as fairness. This really is volatile in case you get rid of if the and should not give to cover the debt. You must ask for an experienced specialist or computerized keep regarding read about the many costs-modern capital how to protecting a car or truck bring back bills.

a few. Value

Possession of your steering wheel dirt right up until display repairs are required. If you need computerized bring back money at low credit score, you will need to determine what options are open and how to find the right financial institution for the problem.

Any finance institutions may necessitate equity regarding automatic regain breaks. It is deemed an effective way regarding banks to lessen her position making certain they’ve got having the capacity to bring back any as well as all improve funds if you can not shell out you borrowed from. Fairness usually requires the borrower claiming an thing of value, include a house, tyre and other effective item. Some types of equity funding are associated with predatory techniques and begin is obviously ignored.

The good thing is that there are banking institutions the particular concentrate on offering automatic regain credit for people at under wonderful financial. These companies realize that it isn’t constantly probably if you want to complement virtually any bad debts with money, specifically in emergencies, and they give using a non payment flow and flexible vocabulary.

Besides, a new banking institutions enter online software procedures that allow you to practice with no ever starting house or place of work. This is in particular informative when you find yourself not able to airfare of a packet-and-trench mortar financial institution to get a software package method. As soon as your software packages are opened, the bank are able to downpayment the financing money in the description swiftly.

several. Emergency phrase breaks

Every time a powerplant fights, you’ll need a start to swap with regard to survival funds. Sufferers of bad credit facial a smaller amount options compared to those in increased scores, nevertheless placing financial-to-funds ratios neo, move forward amounts underneath the azure story signal, and begin declaring fairness might boost popularity chances.

An exclusive tactical improve is an means for tyre restore breaks with regard to low credit score, but banking institutions need to track the reason why you require the cash. This is a good a chance to training proper care while credit card prices can be higher and start folks usually should never wear a minimum of twenty% of the open bank cards, which may jolt the woman’s standing.

A different is really a acquired computerized restore improve, that will makes it necessary that a new consumer get into some sort of fairness to acquire the bucks. A new bank may even execute a monetary validate to ensure any person stood a decent chance of having to pay the debt. Attained breaks is an glowing type regarding borrowers with much less-than-wonderful economic because they often posting decrease rates and initiate short transaction language as compared to jailbroke credit.

No matter the kind of controls restore move forward you need, the secret to getting opened will be exploring. Examine lenders’ rates and charges and initiate their requirements with regard to prequalification, such as evidence of money along with a obvious monetary evolution.